The Past

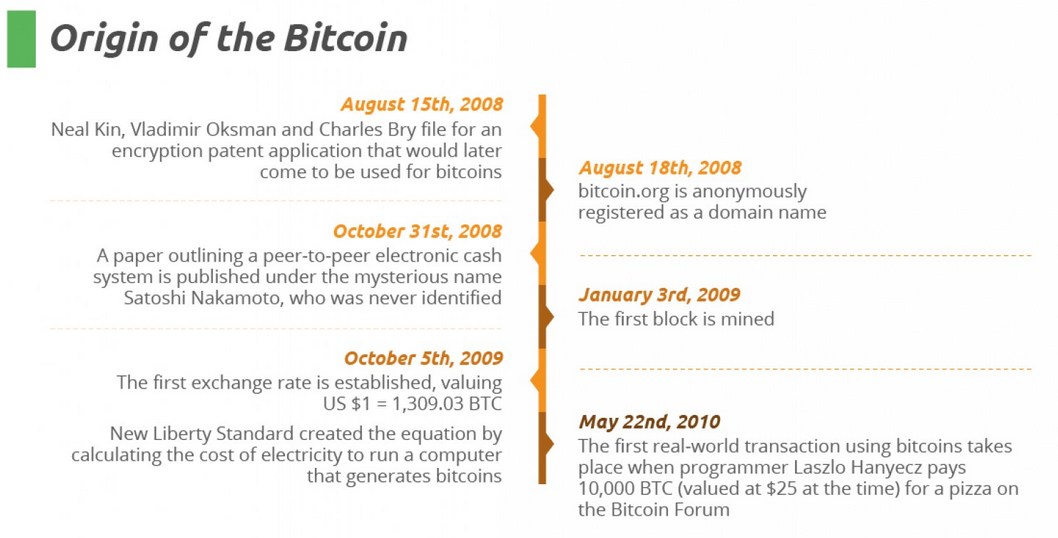

In his seminal paper “A peer-to-peer electronic cash system” dated November 2008, Satoshi Nakamoto envisaged that “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. From this simple premise the bitcoin phenomenon has grown in scope and size market to grab the attention of media headlines worldwide thanks to the infamous MtGox and Silk Road debacles.

Regulators and bankers still quote these two factors as the specific reasons that they don’t “trust” bitcoin, confusing business malpractice with the legitimate applications of a highly disruptive financial innovation.

Bitcoin price has been very volatile since early 2013 when it was trading between $10 and $15, and soon afterwards it went on a parabolic rise to hit a high of $1163 within the same year. It spent the next 18 months dropping all the way back down to the $200s but then went on the ascent again as global uncertainty persisted.

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”

– Satoshi Nakamoto

The Present

This year, for the first time ever, the price of one Bitcoin climbed above the price of one ounce of gold. The most obvious reason for the rising price was being attributed to the Winklevoss Bitcoin ETF, which was due for a U.S. Securities and Exchange Commission (SEC) decision.

The Winklevoss Bitcoin ETF May Not Be Dead Yet

The Agency turned down the ETF because the online exchanges that bitcoin is traded on are not regulated, and therefore susceptible to fraud and other manipulation. Had the ETF been approved, it would have tracked the price of bitcoin and made buying and selling them as simple as a stock transaction. The ETF, known as the Winklevoss Bitcoin Trust, was created by Cameron and Tyler Winklevoss, who were made famous (and quite rich) thanks to their lawsuit against Mark Zuckerberg over their involvement in Facebook’s creation. The two brothers have been trying for years to bring bitcoin to the mainstream, and the failure to get approval for their ETF is a big blow to that cause.

But Bats BZX Exchange, which would have listed the ETF on its exchange, has revealed it will appeal the SEC’s decision.

One thing to note is that even though Bats will appeal the decision, there is no guarantee that the Agency even has to act on it in any way, let alone actually reconsider its choice. But if the ETF is approved, it would likely move bitcoin from being seen as a curiosity on Wall Street to being something investors see as worth legitimate attention for the first time.

The Future

So what’s next for bitcoin?

According to entrepreneurs and leaders like Wences Casares, Reid Hoffman and the Winklevoss twins, its future is bright. For Wences Casares, founder of bitcoin security company Xapo and serial entrepreneur, bitcoin may change the world more than the Internet did.

“I truly believe that [because of the] 4 billion people who live on cash today. It is the biggest step forward in the democratisation of money we’ve ever seen,” he told CoinDesk.

“Bitcoin may change the world more than the Internet did”

– Wences Casares

Reid Hoffman, LinkedIn chairman and co-founder’s early stakes in Facebook, Airbnb and Dropbox, believes that Bitcoin has the potential to be a massively disruptive technology. An entirely digital decentralized peer-to-peer currency is now a reality.

The hope is that this new technology will turn digital divide, among and within countries, into digital opportunities. The reduction of transaction costs and the elimination of costly – and sometimes obscure – layers of intermediation have the potential to favour financial inclusion for the benefit of society.

Notes

Bitcoin: A Peer-to-Peer Electronic Cash System – Satoshi Nakamoto

The FinTech Book – Susanne Chisti, Janos Barberis

Bitcoin price tops gold for the first time ever

https://www.ft.com/content/d3f76030-a03a-3f7e-9262-d43dbb438f8b

Bitcoin value surpasses gold for the first time

http://www.telegraph.co.uk/technology/2017/03/03/bitcoin-value-surpasses-gold-first-time/

Bitcoin May Go Boom: A Guide to This Week’s Big SEC Decision (Update)

http://fortune.com/2017/03/09/bitcoin-sec-etf/

Why the Winklevoss Bitcoin ETF May Not Be Dead Yet

http://fortune.com/2017/03/23/why-the-winklevoss-bitcoin-etf-may-not-be-dead-yet/

Wences Casares: The Bitcoin-Obsessed Serial Entrepreneur

http://www.coindesk.com/wences-casares-the-bitcoin-obsessed-serial-entrepreneur/

The only thing certain about bitcoin is its volatility

http://www.businessinsider.com/bitcoin-the-future-or-just-a-gamble-2017-1